Determining an individual's financial standing, often represented as their net worth, provides a snapshot of their accumulated assets. This figure is calculated by subtracting total liabilities from total assets. Assets include items like real estate, investments, and personal possessions, while liabilities encompass debts and outstanding obligations. In the context of public figures, such data offers insight into their overall financial position and economic standing.

Understanding a prominent figure's net worth can be valuable for several reasons. It illuminates a person's financial journey and accumulated wealth over time. Such information can be relevant for assessing their financial security and impact on various aspects of their life, career, and professional endeavors. Additionally, public awareness of such figures can promote dialogue about financial prosperity, potential success stories, and the factors contributing to wealth accumulation.

This information is integral to understanding the broader picture of financial success and individual economic trajectories. Further exploration of Barry Bostwick's professional career and personal life may illuminate the factors contributing to his financial position. Analysis of factors such as income sources, investment strategies, and expense patterns can provide more context for appreciating his financial situation.

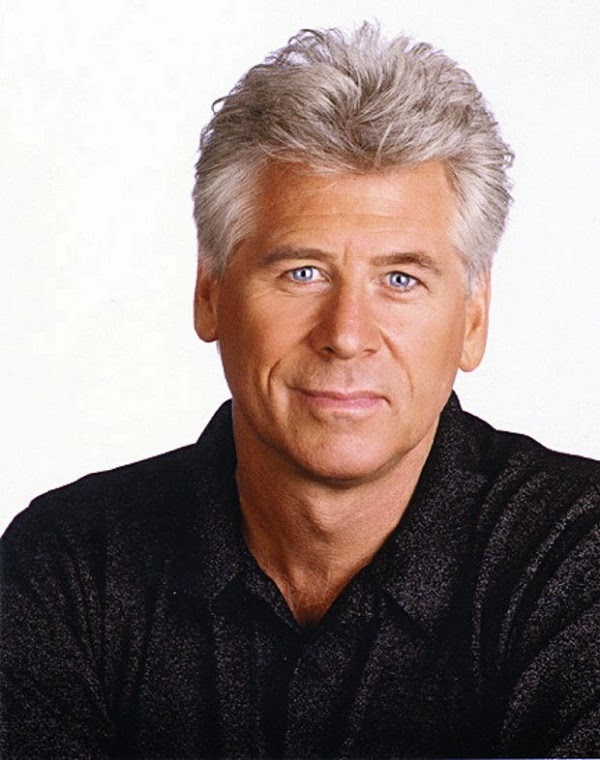

Barry Bostwick Net Worth

Assessing Barry Bostwick's net worth provides insight into his financial standing, encompassing accumulated assets and liabilities. This overview considers key aspects contributing to this figure.

- Income Sources

- Investment History

- Expenses

- Real Estate Holdings

- Professional Earnings

- Asset Valuation

Factors like acting career income, investment returns, and real estate holdings significantly influence Bostwick's net worth. Analyzing these components reveals a more comprehensive picture. For instance, substantial income from a long-running acting career often translates into higher net worth. Similarly, astute investment strategies can yield substantial returns, contributing to a larger overall financial position. Variations in these areas will impact his net worth. The value of real estate assets must also be considered in calculating his total wealth, reflecting the significance of property ownership in financial standing. Evaluating each component is critical to understanding the overall financial picture and provides insight into various factors that may be influential.

1. Income Sources

Income sources directly impact an individual's net worth. The nature and extent of income streams significantly affect accumulated wealth. Analysis of these sources provides crucial insights into the factors influencing overall financial standing. Understanding how various income streams contribute to total wealth is essential for evaluating financial health.

- Acting Career Earnings

Income derived from acting roles is a primary component of a performer's financial position. Consistent and substantial roles can translate to substantial earnings, positively affecting accumulated wealth. Earnings vary considerably depending on the nature of roles, production size, and prevailing market conditions. The longevity and success of an acting career often correlate with a higher net worth due to sustained income.

- Investment Income

Investment returns, encompassing dividends, interest, and capital appreciation, contribute to overall wealth. Investment decisions can significantly impact an individual's financial trajectory, reflecting the importance of astute management of assets. Diversification of investments and risk tolerance are critical in generating positive returns over time.

- Potential Secondary Income Streams

Supplementary sources, such as endorsements, brand collaborations, or other entrepreneurial ventures, add complexity to the income picture. The presence and profitability of these activities can substantially influence the individual's net worth. A diverse portfolio of income streams can create a more robust and secure financial foundation.

- Real Estate Income

Income generated from rental properties or other real estate holdings provides additional financial support. The revenue generated from property ownership contributes to overall net worth and financial stability. The success of these activities is contingent on property value appreciation and rental income streams, both crucial elements in determining the ultimate impact on net worth.

Considering the various income sources, from primary acting roles to supplementary investments and real estate holdings, demonstrates the multifaceted nature of wealth accumulation. The interplay between these sources provides a comprehensive understanding of how different income streams contribute to the overall net worth of an individual. Analyzing these components provides a detailed understanding of the factors influencing financial standing.

2. Investment History

Investment history significantly influences an individual's net worth. Investment decisions, including timing, diversification, and risk tolerance, are pivotal components in wealth accumulation. Successful investment strategies often translate into substantial capital growth, thereby increasing the overall net worth. Conversely, poor investment choices can lead to financial losses and a reduction in net worth. The impact of investment history is evident in how choices made over time contribute to the total financial standing. The historical performance of investments reveals insights into an individual's approach to wealth management.

The importance of investment history cannot be overstated. It provides a crucial perspective on an individual's financial acumen and risk management. Careful consideration of past investment choices, outcomes, and lessons learned can shape future strategies, potentially leading to greater success. For example, a history of shrewd investments in diverse asset classes like stocks, bonds, and real estate can result in a considerable increase in net worth over time. Conversely, a history of speculative investments or limited diversification could result in greater volatility and potentially lower returns in the long term. The impact of such choices on net worth is demonstrable through financial statements and portfolio analysis.

Understanding the connection between investment history and net worth is crucial for comprehending the complexities of wealth creation and management. A thorough review of investment choices, considering both successes and failures, can yield valuable insights for future financial decision-making. By analyzing historical trends, individuals can better understand the factors contributing to their financial position. This understanding can be applied to refine investment strategies and potentially achieve better financial outcomes. The insights gained from analyzing past investment choices contribute to a comprehensive understanding of financial success.

3. Expenses

Expenses represent a crucial component in understanding Barry Bostwick's net worth. Control and management of expenses directly affect the overall financial picture. Significant expenditures, whether on living costs, personal interests, or investments in other ventures, inevitably influence the amount remaining for savings and potential capital growth. High expenses can strain resources, potentially hindering wealth accumulation. Conversely, judicious expense management allows for higher savings rates and accelerated growth in net worth.

Expenses encompass a broad spectrum of costs. Living expenses, including housing, utilities, and daily necessities, are fundamental considerations. Personal interests, like hobbies and entertainment, contribute to discretionary spending. Investment expenditures, representing outlays on potential future gains, are also essential to consider. Healthcare costs, often unpredictable and significant, further complicate the expense calculation. The interplay between these various expenditure categories, and how these expenses relate to income sources and investment returns, are vital to determining net worth. Analysis of historical expenses, in relation to income, reveals crucial patterns in spending habits. This insight is critical for understanding the evolution of financial stability over time.

The significance of expense management is evident in its impact on net worth. By strategically managing expenses, an individual can maximize savings, allocate funds for investments, and ultimately increase wealth. Conversely, uncontrolled or excessive expenses can diminish resources, potentially leading to a decrease in net worth. This principle is widely applicable across diverse financial situations. Understanding the relationship between expenses and income, therefore, is paramount for evaluating financial health and potential for future wealth accumulation. Analyzing historical expense patterns provides a valuable perspective on financial strategies adopted by an individual, further illuminating factors contributing to their overall net worth.

4. Real Estate Holdings

Real estate holdings represent a significant component in determining an individual's net worth. The value of property owned, whether residential or commercial, directly contributes to the overall financial picture. Appreciation in property value, rental income, and strategic investment in real estate can significantly influence a person's financial position. Evaluating these holdings is crucial for assessing the overall financial standing of individuals such as Barry Bostwick.

- Property Value and Appreciation

The market value of real estate assets plays a critical role in calculating net worth. Changes in market conditions can influence property valuations, impacting the overall financial position. Consistent appreciation in property value over time contributes positively to net worth. Conversely, market fluctuations can result in decreased property values and a negative impact on the financial standing.

- Rental Income Generation

Rental properties generate income streams, which directly contribute to net worth. The amount and consistency of rental income are key factors in evaluating the financial implications of real estate holdings. Active management of rental properties, including tenant selection and maintenance, affects rental income and overall profitability.

- Investment Strategy and Portfolio Diversification

Real estate investment strategies contribute to overall portfolio diversification. Decisions regarding the type of property, location, and market conditions influence investment returns and, consequently, net worth. Strategic decisions regarding property acquisition and management are integral to a comprehensive investment strategy, playing a role in maximizing potential returns and enhancing financial health.

- Influence of Location and Market Conditions

Location significantly impacts property values and rental income potential. Factors like local economic trends, proximity to amenities, and general market demand influence real estate investment returns. Evaluating market conditions and local trends informs informed real estate decisions, influencing potential returns and overall net worth.

The influence of real estate holdings on net worth is multifaceted. The interplay of property values, rental income, investment strategies, and market conditions are crucial elements in determining an individual's financial standing. Understanding these factors provides a clearer picture of the overall contribution of real estate to an individual's financial position and is especially pertinent when assessing the financial standing of public figures like Barry Bostwick.

5. Professional Earnings

Professional earnings represent a substantial component in determining an individual's overall net worth. The nature and extent of earnings from professional endeavors significantly influence accumulated wealth. For figures like Barry Bostwick, analysis of professional earnings reveals crucial insights into the factors shaping their financial standing.

- Consistent Income Streams

A consistent and substantial income stream from a career, such as acting, is a primary driver in building substantial net worth. Regular and predictable earnings allow for savings, investment, and overall financial stability. Sustained high-income periods, like those seen in certain acting careers, enable significant contributions to overall wealth accumulation over time.

- Variability in Income

The entertainment industry often presents fluctuating income patterns. Projects may come and go, leading to temporary periods of higher or lower earnings. Understanding and adapting to these income variations is crucial for long-term financial stability. Financial strategies, including investments and cost management, must account for these fluctuations.

- Impact of Career Stage

Different career stages bring varying earning potential. Early-career roles often result in lower earnings compared to later-career endeavors with greater experience and higher-profile projects. Evaluating an individual's professional income across different career phases offers a more nuanced perspective on their earning potential and overall financial trajectory.

- Role of Industry Compensation Standards

Compensation standards within specific industries, like the entertainment industry, influence professional earnings. Factors such as market demand, experience level, and role type influence compensation packages. Understanding the standards in an actor's field provides context for analyzing the income and its impact on net worth.

Analyzing professional earnings provides a key component in understanding the total picture of an individual's net worth. The interplay between consistent income, income variability, and career-stage impacts demonstrates the multifaceted nature of wealth accumulation. Consideration of industry standards further illuminates the context of professional earnings within an individual's overall financial standing, as exemplified in the career of figures such as Barry Bostwick. Factors such as career longevity and the success of various projects all play a part in determining the amount of income that has been accumulated throughout their career.

6. Asset Valuation

Asset valuation is fundamental to determining net worth, including that of Barry Bostwick. Accurate assessment of assets is crucial for a precise calculation of net worth. This involves determining the current market value of various holdings. Inadequate or inaccurate valuation can lead to a misrepresentation of one's financial position.

The process of asset valuation involves considering various factors specific to each asset type. Real estate, for example, requires considering location, condition, market trends, and comparable sales. Investment holdings, like stocks and bonds, depend on current market prices and projected future performance. Personal possessions, such as cars or collectibles, require evaluation based on current market demand and condition. Valuation methodologies used should be consistent and reflect prevailing market conditions. For Barry Bostwick, accurately assessing assets like real estate, investments, and potentially other valuable possessions, is crucial for a precise understanding of his total financial worth.

Precise asset valuation is crucial for several reasons. It ensures an accurate representation of net worth, allowing for informed financial decisions. It permits proper financial planning, by demonstrating the real value of assets, not just their historical cost. This process facilitates effective comparisons of financial situations across individuals and over time. Understanding asset valuation principles is critical for anyone wanting to assess or understand their net worth or that of a public figure like Barry Bostwick. Accurate valuation creates a reliable foundation for various financial strategies and permits comparisons of financial health over time. A detailed understanding of the factors influencing asset valuation supports sound judgment in financial decision-making and illuminates the complexities of wealth accumulation.

Frequently Asked Questions about Barry Bostwick's Net Worth

This section addresses common inquiries regarding Barry Bostwick's financial standing, encompassing income sources, asset valuation, and overall wealth accumulation.

Question 1: What are the primary sources of income for Barry Bostwick?

Barry Bostwick's income primarily stems from his career as an actor. Consistent work in film, television, and theater generates significant earnings. Potential supplementary income may include investments, endorsements, and other entrepreneurial ventures, although details regarding these supplementary sources are limited and not publicly available.

Question 2: How is Barry Bostwick's net worth determined?

Determining net worth involves subtracting total liabilities from total assets. Assets include various holdings such as real estate, investments, and personal possessions. Liabilities encompass debts and outstanding obligations. The process requires careful valuation of all assets, which may vary depending on factors such as market conditions and asset type.

Question 3: What is the role of investment income in Barry Bostwick's overall financial standing?

Investment income, derived from various sources like stocks, bonds, or real estate, is likely a component of Barry Bostwick's net worth. Investments' performance and diversification strategies significantly impact the overall financial position. Information regarding these specifics is not publicly available.

Question 4: How do expenses influence the calculation of net worth?

Expenses, encompassing living costs, investments, and personal interests, directly impact net worth. A detailed analysis of expenses, coupled with income sources, provides a clearer picture of financial health and wealth accumulation. High expenses relative to income can diminish savings potential, whereas prudent expense management fosters savings and investment opportunities.

Question 5: What are the limitations of publicly available information about net worth?

Publicly available information about net worth, especially for private individuals, is often incomplete. Detailed financial records are usually not accessible, which may limit understanding of intricate details like specific asset types or investment strategies. Publicly known figures can often be based on estimations or previous reports.

Question 6: Why is understanding net worth important?

Understanding net worth, especially for public figures, offers insight into overall financial stability and provides context for career achievements. It also allows for public discussion about the factors contributing to financial well-being. However, public figures' net worth shouldn't be the sole measure of their success or worth.

Understanding the complexities of net worth necessitates a comprehensive understanding of various factors influencing an individual's financial position. This overview highlights common concerns, but detailed specifics are often unavailable.

This concludes the FAQ section and transitions to the next article section on professional analysis.

Tips Regarding Net Worth

Understanding and managing one's financial position, including net worth, requires a strategic approach. Effective strategies for wealth management involve prudent financial decisions and responsible resource allocation.

Tip 1: Track Income and Expenses Accurately. Maintaining detailed records of income and expenses is essential for assessing financial health. This involves meticulous logging of all sources of income and categorization of expenditures. Tools like spreadsheets or budgeting apps facilitate this process. Regular review of these records helps identify trends and areas for improvement in financial management.

Tip 2: Develop a Comprehensive Budget. Establishing a budget is vital for effective financial planning. Categorize expenses into essential needs and discretionary spending. Prioritize essential expenses like housing, food, and transportation. Allocating funds for savings and investments is crucial for future financial security. Flexible budgeting allows adjustments based on income changes or unforeseen circumstances.

Tip 3: Prioritize Debt Reduction. High-interest debt, such as credit card debt, significantly impacts net worth. Prioritizing debt reduction strategies, such as the debt avalanche or debt snowball methods, can free up funds for savings and investment. Debt reduction accelerates the accumulation of wealth.

Tip 4: Invest for the Long Term. Investing in diverse asset classes, like stocks, bonds, real estate, or mutual funds, is a fundamental aspect of long-term wealth accumulation. Strategic asset allocation and diversification mitigate risks while potentially maximizing returns. Investments should align with individual risk tolerance and financial goals.

Tip 5: Seek Professional Advice. Consulting financial professionals, such as certified financial planners, can provide valuable guidance for developing a comprehensive financial plan. Professionals offer tailored advice based on individual circumstances and financial objectives. Professional insights provide a detailed strategy to achieve financial goals.

Tip 6: Regularly Review and Revise Financial Plans. Financial circumstances and goals often change. Regularly evaluating financial plans and adjusting strategies, as needed, ensures alignment with evolving circumstances. Flexibility in financial planning allows for adaptation and optimization of financial strategies.

Implementing these tips provides a structured approach to manage financial resources and achieve long-term financial well-being. Careful consideration of income, expenses, and investment strategies promotes effective wealth management.

By following these strategies, individuals can create a solid foundation for long-term financial success. Further exploration of specific financial strategies can lead to improved wealth management, leading to a more comprehensive understanding of financial success.

Conclusion

Assessing Barry Bostwick's net worth necessitates a comprehensive analysis of various contributing factors. Income sources, including professional earnings and potential investment returns, play a critical role. The valuation of assets, particularly real estate holdings and investments, is essential for an accurate representation of financial standing. Expense management and historical patterns of spending also provide valuable insights. Understanding the intricacies of these elements allows for a deeper comprehension of the factors influencing overall financial prosperity.

While detailed specifics regarding Barry Bostwick's financial situation remain often unavailable to the public, exploring the principles of wealth accumulation, asset management, and expense control provides a framework for understanding personal financial success. Analysis of these core concepts, as exemplified through public figures like Barry Bostwick, offers insights applicable to individual financial planning and management strategies. This understanding underscores the multifaceted nature of financial well-being and the crucial role played by conscious financial decisions in achieving long-term prosperity. Further research might illuminate additional aspects of Barry Bostwick's financial journey.

You Might Also Like

Diana Taurasi Net Worth 2023: How Rich Is She?Leo DiCaprio Net Worth 2024: A Deep Dive

Orson Welles Net Worth At Death: A Look At His Legacy

Keanu Reeves Net Worth: 2024 Update & Secrets

Rachel Macfarlane Net Worth 2023: A Look Inside

Article Recommendations